At the turn of the century, NASCAR began implementing a series of changes to how races were broadcast. Flag-to-flag coverage had been in place for many years, but individual tracks struck deals with different networks for the rights to broadcast each race. Fans could expect to see their favorite drivers making laps on networks like ABC, CBS, ESPN, NBC, TBS, and TNN. Some may even recall when Speed Channel carried races, particularly truck series events. Due to the rising popularity of motorsports events, NASCAR – in all its infinite wisdom – decided to centralize broadcasting rights by creating their own deals with networks and taking the tracks out of the negotiations.

The first round of deals had the season split between Fox and its affiliates and NBC and its affiliates, much like today. Races were split between the two broadcasting groups but could appear on any of a variety of channels those two groups owned. An annually-alternating schedule was created so that each broadcasting group had the opportunity to cover the bigger races like the Daytona 500 and the season ending races. With the change of multiple broadcasting networks during the early 2000s, fans were sometimes left to channel surf until they could find the race.

When the first round of contracts came up for renewal at the end of the 2006 season, more changes were announced. ESPN and ABC were in and NBC was out. Races were now airing on FOX, ESPN, ABC, and TNT throughout the season. The Chase for the Cup was introduced. Standardized start times were implemented. Practice and qualifying were given flag-to-flag coverage. For a few years, DirecTV even offered a Hot Pass that provided exclusive content specific to a few drivers, including airing team communications and briefly offering commentators specific to that channel.

In 2012 and 2013, negotiations took place to write new contracts for the next ten years of broadcasting rights, running through the end of the 2024 season. ESPN was out and NBC was back in again, with FOX remaining as the constant from renewal to renewal. With the new contracts, NASCAR secured $8.2 billion between the two contracts, FOX got the first half of the season, and NBC got the second half. Thus began the broadcasting schedule to which most fans have grown accustomed.

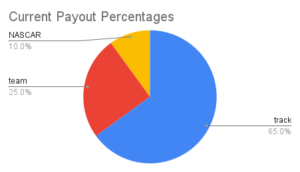

Negotiations have now begun for the next series of contracts, expected to run eight to ten years. Rumor has it that ABC/ESPN are hoping to reenter negotiations and either replace one of the two networks currently under contract or become a third network involved in the broadcast of NASCAR events from each series. With the previous contracts bringing over $800 million in revenue annually, one could expect future contracts to be worth even more. Of the funds coming in, NASCAR retains 10% while 25% goes to teams and 65% goes to the tracks. The desire for tracks to retain multiple races per season makes even more sense now.

Not much has been said lately about the negotiations between NASCAR and the teams because, frankly, there haven’t been any negotiations. A panel of team representatives met with NASCAR officials last month to discuss a redistribution of percentages and were basically told to cut costs themselves if they wanted more revenue. With teams already shouldering the responsibility of attracting and retaining the vast majority of sponsors, there seems to be a significant funding imbalance. For teams running in the Cup series, expenses are already high and the requirement for single-source parts means costs can really only be cut by downsizing team sizes and no one wants to do that if they can help it. Many teams already have team members working multiple jobs (like hauler drivers who are also jackmen and interior design engineers who are also car wrap installers). How can they be expected to trim expenses when they already run lean?

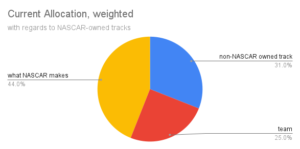

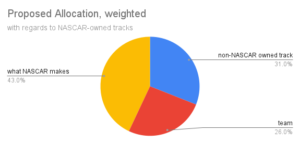

A reallocation of earnings from broadcasting rights could be a significant positive impact on teams, especially the ones who already struggle to make ends meet. Even a seemingly small change of NASCAR’s 10% cut going down to 9% and teams’ cut going up to 26% would mean an extra $8.2 million to teams next season. Split evenly across the 17 full-time teams, that would be an extra almost half-million dollars per team to spend on recruiting and retaining the best team members, upgrading equipment, and making whatever other adjustments may need to be made to the NextGen chassis to make drivers safe.

With all the other sources of revenue (ticket sales, merchandising and licensing fees, concessions, driver and crew penalties, etc.), NASCAR probably brings in around $400 million a year. (Because NASCAR is a privately owned corporation, overall revenue and expenses are not public knowledge and can only be put together based on what information NASCAR releases to the public.) Surely, they wouldn’t miss $8 million, a meager 2% of their estimated annual revenue. After all, NASCAR owns Auto Club Speedway, Chicago Street Course, Chicagoland Speedway, Daytona, Darlington, Homestead-Miami, Iowa, Kansas, Martinsville, Michigan, Phoenix, Richmond, Talladega, and Watkins Glen. They get revenue from these tracks during race weekends and also throughout the year by hosting other events, like drive-thru Christmas lights, music concerts, and other sporting events. There’s definitely some wiggle-room to keep money flowing in and heading to the teams and that wiggle-room can be found inside NASCAR’s own accounts. It’s time for some adjustments to payouts. NASCAR needs to take care of their teams before the teams are forced to shut down or move to a new circuit. Maybe SRX Racing needs to look at expanding its schedule?